SimFinSimApp

The Simple Financial Simulator App (SimFinSimApp) is intended to give some sense of the financial context involved in saving for retirement. It provides values for 4 common savings scenarios. Note however these are mathematical/algorithmically, along with simplifying assumptions, derived values and so should not be construed as any sort of financial advice. Any use of these values for personal use is at the users own risk. There is absolutely no warranty, expressed or implied, for the use of this software and its results.

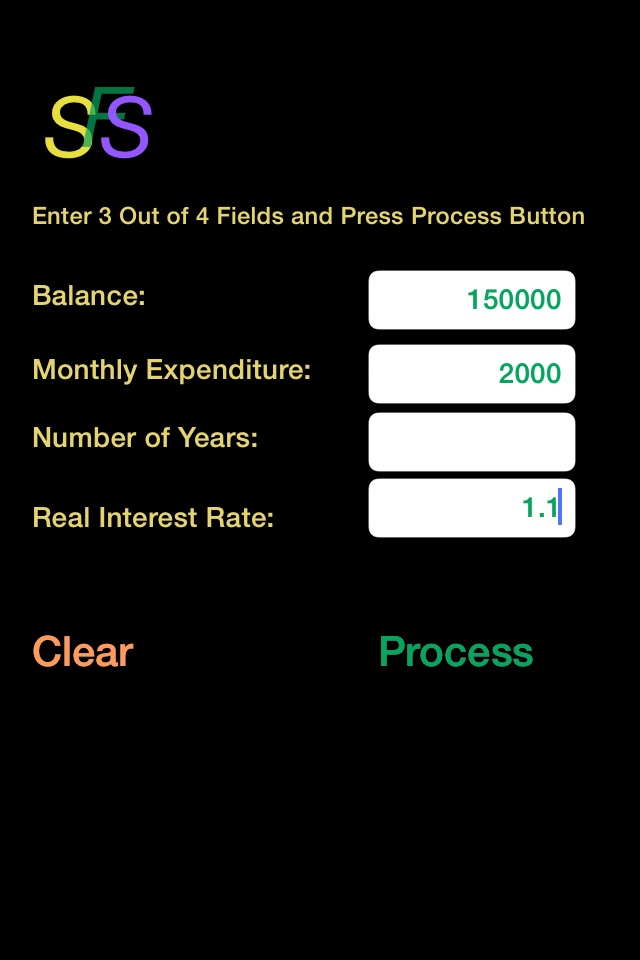

Four values are supported. That is, any of the four values can be derived by providing the other three values. The four supported values are:

Balance. The balance is the total amount you have available.

Initial Monthly Expenditure. This is the amount you would like to spend each month starting today. When calculating results, the average United States monthly inflation rate (3.34%) is applied at a yearly rate.

Number of Years. This is the number of years the balance, adjusted by the real interest rate (see next), will last given the monthly expenditure adjusted for inflation. Note that parts of years are possible with fractional number of years. For example 4.5 years is equivalent to 4 years and 6 months.

Real Interest Rate. This is the interest rate with the average inflation rate subtracted from it. For example, if the interest rate on the balance is 4.34%, the real interest rate is 1.0% since 3.34% will be subtracted from it. This is the rate above inflation needed to make the balance last a number of years with the monthly expenditure.

Examples

Compute Balance. What is the balance needed to spend 2000.00 per month adjusted for inflation for 6.5 years and have a real interest rate of 1.10%? The answer is 150197.77.

Compute Initial Monthly Expenditure. What is the monthly expenditure adjusted for inflation that can be supported with a balance of 150000.00 for 6.5 years and with a real interest rate of 1.10%? The answer is 2002.79.

Compute Number of Years. What is the number of years a balance of 150000.00 will last with a monthly expenditure of 2000.00 adjusted for inflation with a real interest rate of 1.10%? The answer is 6.5 years.

Compute Real Interest Rate. What real interest rate is needed to cause a balance of 150000.00 to last 6.5 years with a monthly expenditure of 2000.00 adjusted for inflation? The answer is 1.25%. If you note the previous examples had a real interest rate 1.10% for the same scenario. Here the system derived 1.25% instead. This is an example of precision error.